Hosted tokenisation button

Use the hosted tokenisation button integration to seamlessly embed Google or Apple Pay buttons into your checkout page through our Secure Fields. With this integration we manage the onboarding process with the wallet provider and offer you a straightforward and hassle-free method to gather card details stored within cardholders' wallets.

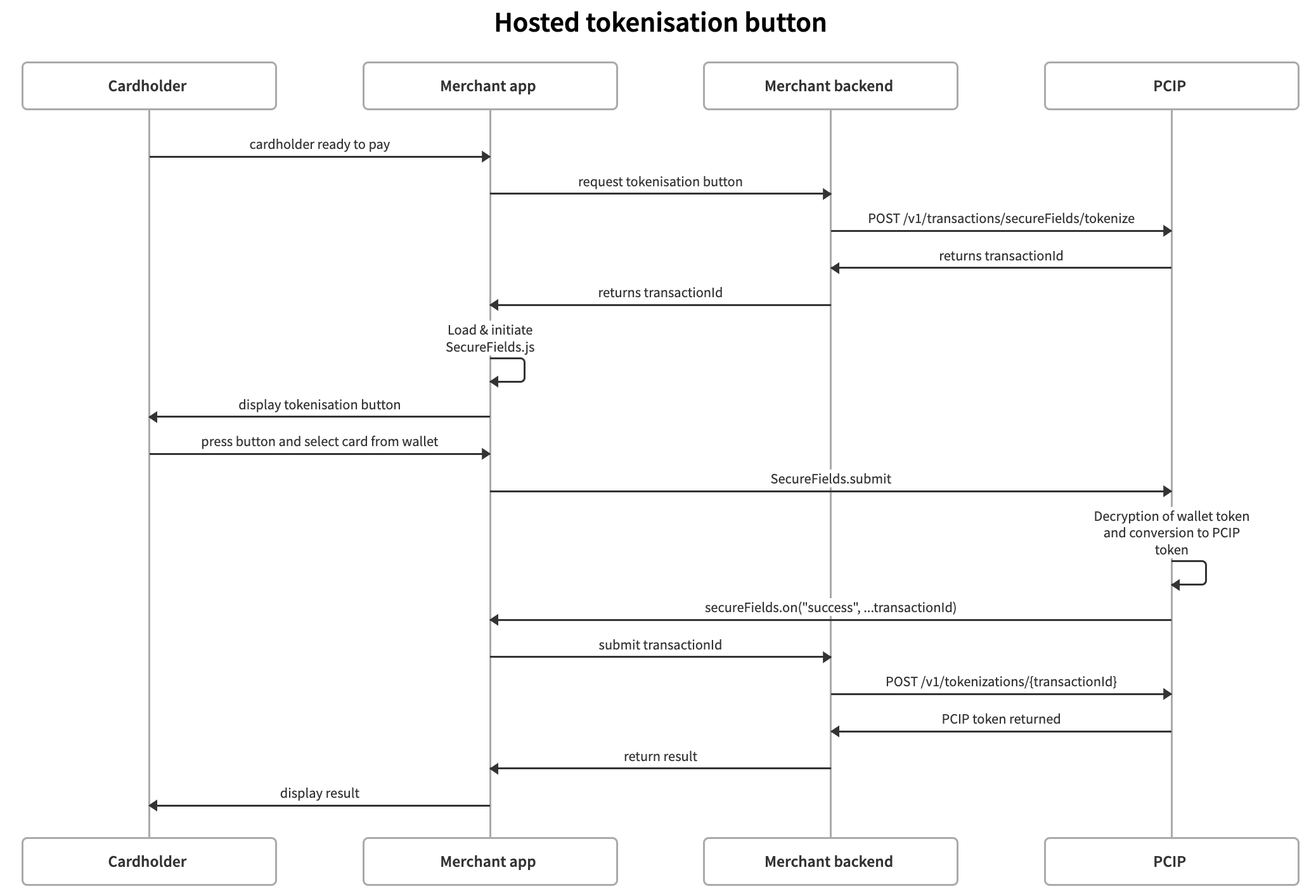

Process overview

Find below a high-level overview of the process flow:

Activation

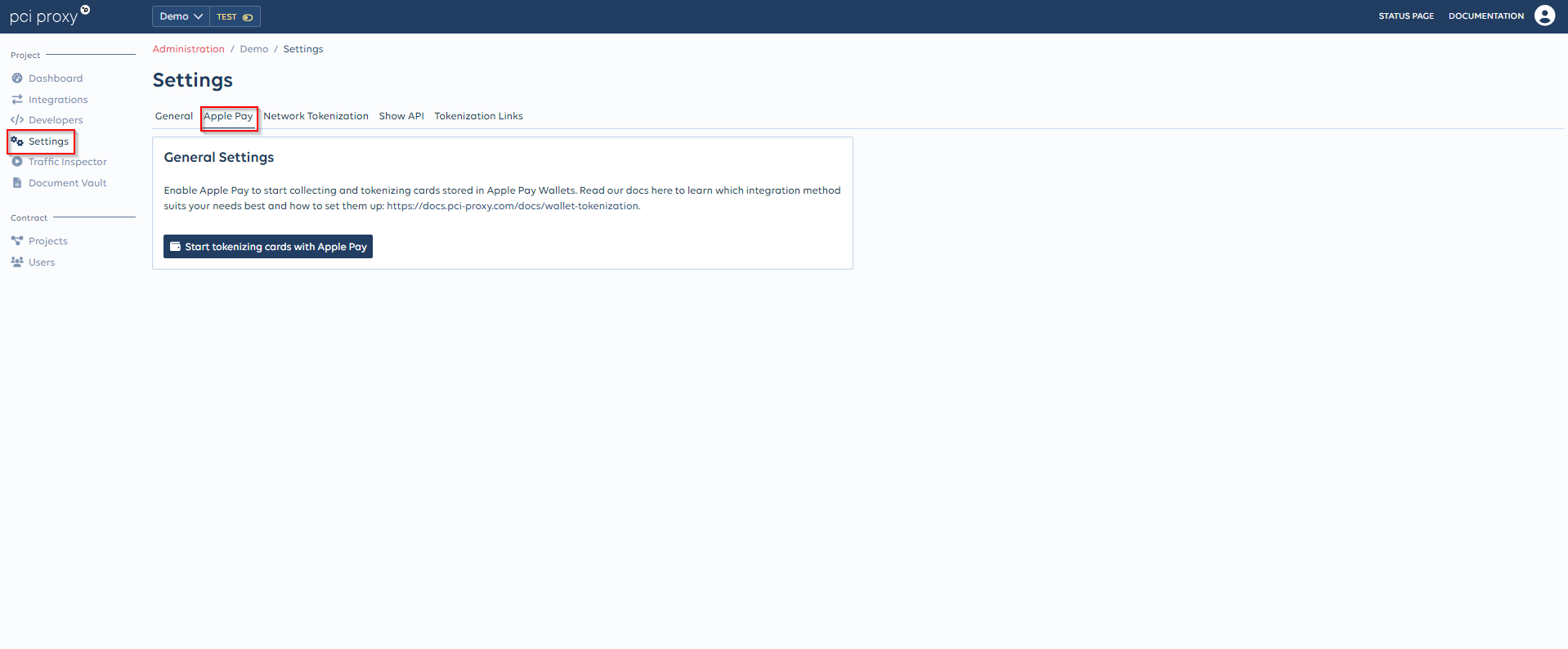

Apple Pay

To complete the onboarding at Apple please login to the Dashboard and navigate to the Developers menu within the project section. Open the Apple Pay Settings tab and enable Apple Pay if not already done.

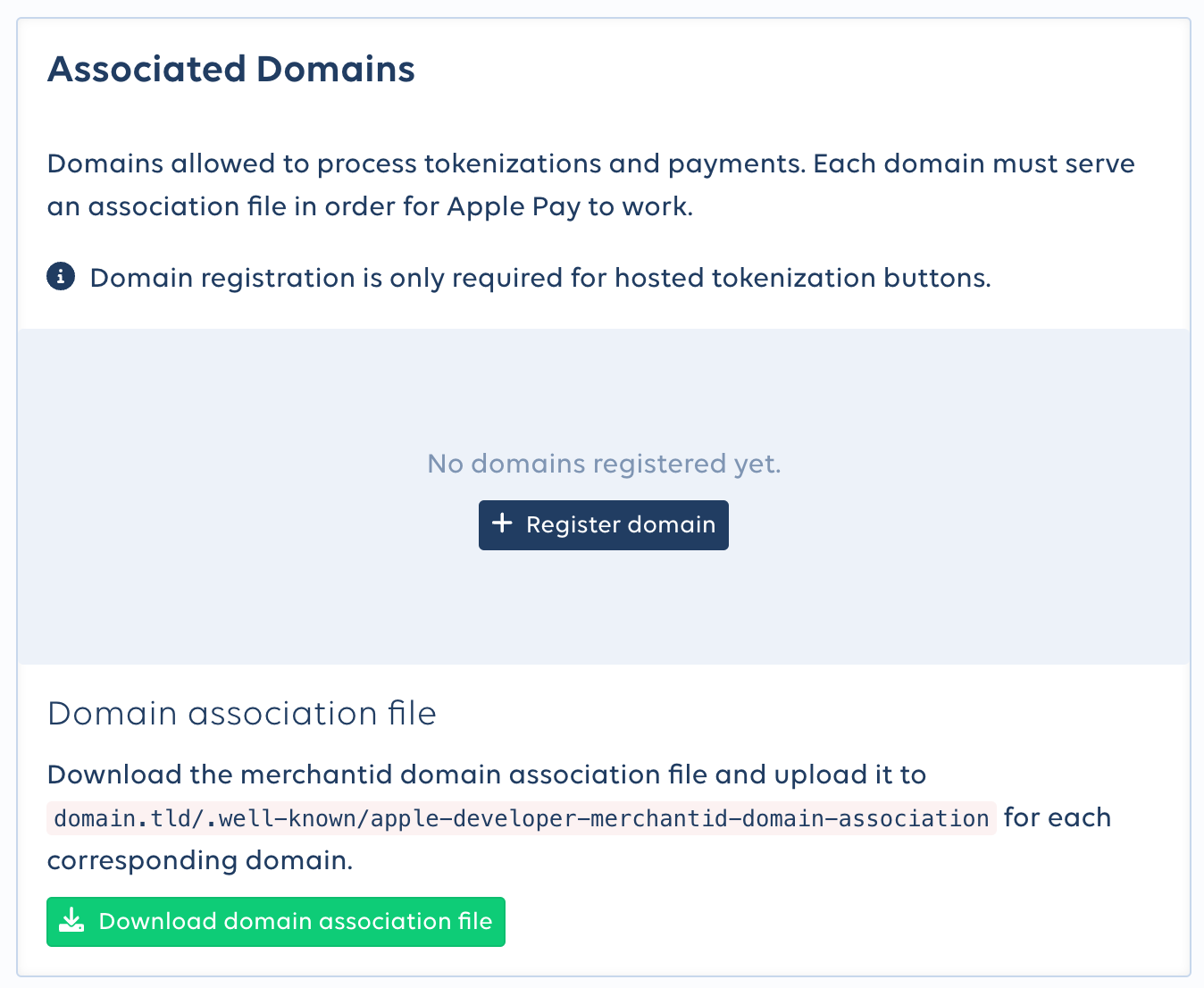

In the next screen configure the name you want to display on the Apple Pay payment sheet showed to the cardholder and press the Enable button. Finally add your domains and subdomains where the Apple Pay button will be hosted by adding the URLs in the Associated Domains section as shown below:

Google Pay

No setup required for Google Pay as PCI Proxy is taking care of it behind the scenes.

Setup Tokenisation button

Follow the recipe below to get started:

Setting up payment methods

By default, all credit card types available in your merchant setup will be accepted. You can use the paymentMethods object to specify a subset of card types if you need to. The selection will apply to Google and Apple Pay if initisalised at the same time. For example,

secureFields.init(transactionId,

{

googlePay: "googlepay-container",

applePay: "applepay-container"

},

{

paymentMethods: ["ECA", "VIS"]

}

);Initialise tokenisation

To capture card data with the Tokenisation button, you need to initialize a transactionId via a server-to-server call first. Call our secureFields/tokenize endpoint with your desired parameters and we will return a transaction identifier ready to be used with our Secure Fields.

For the full API specification please see the API reference

curl -L -X POST 'https://api.sandbox.datatrans.com/v1/transactions/secureFields/tokenize' \

-H 'Authorization: Basic {{basicAuth}}' \

-H 'Content-Type: application/json' \

--data-raw '{

"applePay": {

"merchantName": "Merchant Name",

"currency": "CHF",

"amount": 100,

"country": "CH"

},

"googlePay": {

"currency": "CHF",

"amount": 100,

"country": "CH",

"allowedAuthMethods": [

"CRYPTOGRAM_3DS"

]

}

}'{

"transactionId": "230919162326558204"

}

Strong Customer Authentication (SCA) dataMerchants which are subject to Strong Customer Authentication must make sure to submit

countryandamount. Not providing the correct amount or country might impact the liability shift.Make sure that

amountmatches with the amount which will be authorized and charged to the cardholder in any downstream payment. It is also the value which will be displayed in the payment sheet presented to the cardholder.

Request PCI Proxy token

Once you have transmitted the transactionId from the client to your server, you then need to execute a server-to-server POST request to retrieve the PCI Proxy token and 3D data provided by the wallets if available.

Check the walletIndicator parameter to see the original wallet provider of the returned token. For Google Pay, it returns PAY and for Apple Pay APL.

Strong Customer Authentication and liability shiftGoogle Pay

The Google Pay API might return cards on file on Google.com (

PAN_ONLY) or a device token on an Android-powered device authenticated with a 3D-Secure cryptogram (CRYPTOGRAM_3DS). The type of authentication method you want to accept, is defined in theallowedAuthMethodswithin the googlePay object in the initialisation request.In case of a

CRYPTOGRAM_3DSenabled card, 3D-Secure related data such as theeciandcaavvalues will be present in the3Dobject of the get TOKEN API response. For cards withPAN_ONLYauthentication, no3Dobject is returned and a separate 3D-Secure authentication step might be required. Refer to 3D Secure Authentication if you want to process 3D-Secure authentications with PCI Proxy.Apple Pay

Visa Apple Pay tokens come with 3D-Secure data elements (

eciandcaav) in the3Dobject of the get TOKEN API response as Apple Pay is only returning device PANs (DPAN). For Mastercard tokens theecivalue is not available.

Example Request & Response

curl -L -X POST 'https://api.sandbox.datatrans.com/v1/tokenizations/{{transactionId}}' \

-H 'Authorization: Basic {{basicAuth}}' \

-H 'Content-Type: application/json'{

"alias": "7LHXscqwAAEAAAGLbFhOeHrXIiMLAEcX",

"fingerprint": "F-dN4ZBIp_rGghxyGVlDmVOv",

"maskedCard": "412374xxxxxx0013",

"expiryYear": "25",

"expiryMonth": "06",

"cardInfo": {

"brand": "VISA",

"type": "credit",

"usage": "consumer",

"country": "US",

"issuer": ""

},

"walletIndicator": "APL",

"3D": {

"cavv": "Yzu7ORQAA1LQNMiNlUP6MAACAAA=",

"eci": "5"

},

"last4": "1914"

}{

"alias": "7LHXscqwAAEAAAGLbRHwv1vpwvThAOyd",

"fingerprint": "F-dN4ZBIp_rGghxyGVlDmVOv",

"maskedCard": "412374xxxxxx0013",

"expiryYear": "25",

"expiryMonth": "06",

"cardInfo": {

"brand": "VISA",

"type": "credit",

"usage": "consumer",

"country": "US",

"issuer": ""

},

"walletIndicator": "PAY",

"3D": {

"cavv": "AgAAAAAABk4DWZ4C28yUQAAAAAA=",

"eci": "07"

},

"last4": "1914"

}{

"alias": "7LHXscqwAAEAAAGK4UF0bShLshqhAGri",

"fingerprint": "F-fkO8WHlN03g-bhs44wFI9J",

"maskedCard": "412374xxxxxx0013",

"expiryYear": "25",

"expiryMonth": "06",

"cardInfo": {

"brand": "VISA",

"type": "credit",

"usage": "consumer",

"country": "US",

"issuer": ""

},

"walletIndicator": "PAY",

"last4": "0013"

}Check

last4to see the original last four digits of the full pan (FPAN). Values returned in themaskedCardelement represent the masked device pan (DPAN) - except for the Google PayPAN_ONLYflow where the FPAN is returned as masked value.

Showcase & Examples

The source code for the integrations is hosted on our GitHub Repository. To see an an interactive demo please visit here: Online demo

Updated 4 months ago